- A Roth account is one of the only ways you can grow your investments and not be taxed.

- Roth eligibility is restricted, so take advantage of it in the years you are eligible.

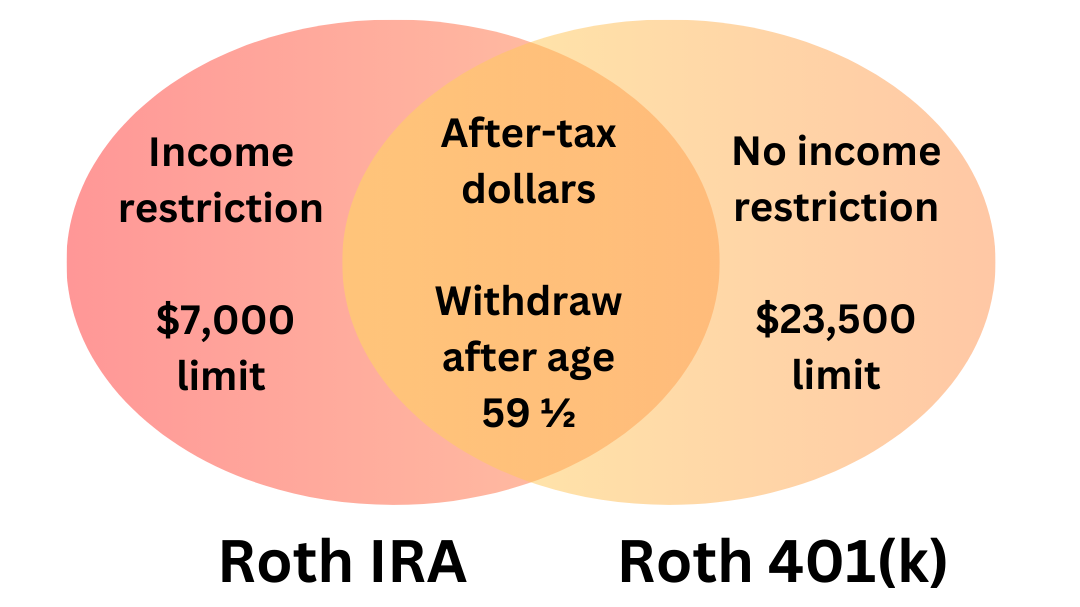

ROTH IRA

Roth IRAs are an incredible deal that should not be missed! A Roth IRA is a particular type of savings account meant for your long-term savings. It is special because you will never pay taxes on the part that grows (as long as you wait until age 59½ to take it out). Every other part of your income will be taxed in some way. Your salary gets taxed every year. Your investments get taxed when you sell them. Your retirement accounts get taxed when you withdraw from them during retirement. But the earnings on a Roth IRA are NEVER taxed!

Rules on Roth IRAs

- You have to have earned income, such as from a job, to contribute to a Roth IRA.

- You can contribute as much as your earned, up to $7,000 per year (2025 limit).

- Contribution allowance starts phasing out if your income is over $150,000 (single) or $236,000 (married filing joint) for the year (2025 limit).

- You can open a Roth IRA at any age, but you will need a guardian to act as the custodian if you are under 18 or 21 (depending on the state you reside).

- If you badly need money, you can withdraw your Roth contributions (not earnings) at any time with no penalty. This is a wonderful flexibility of Roth IRAs that is not true with other types of retirement accounts.

- You will pay a penalty if you withdraw the earnings on your contributions before age 59½, so it’s a really bad idea to tap into that portion.

To be clear, you have to earn money to be eligible to contribute to a Roth IRA. Allowance, gifts, and bank interest do not count as earned income. Working for your family business and babysitting do count as earned income if you report the income to the IRS. Only as much as you earn each year can go into the Roth IRA regardless of how much more money you have in your savings.

ROTH 401(k)

Your employer might offer both a 401(k) and a Roth 401(k). The Roth 401(k) has benefits just like the Roth IRA described above, but with two special features. There are no income restrictions as to who can contribute to a Roth 401(k) and the contribution limit is much higher than with a Roth IRA. The 401(k) contribution limit ($23,500 in 2025) applies to your combined contributions to the 401(k) and Roth 401(k), so you need to prioritize how to divide your money between the two.

The Roth 401(k) has one disadvantage compared to the Roth IRA. The Roth IRA has this very special feature that if you are super desperate for cash, you can withdraw the contributions portions of your Roth IRA without penalty. If you withdraw any part of your Roth 401(k) before age 59 ½, there will be a penalty.

If your company offers you both a 401(k) and Roth 401(k), you’ll want to consider the tax implications before choosing. Pre-tax dollars go into your 401(k), meaning the money comes straight from your paycheck without being subject to federal or state tax. All the tax will be paid when you make withdrawals during retirement. On the other hand, a Roth 401(k) is funded with after-tax dollars. You have already paid taxes on what you earned and contributed. There will be no tax on the investment earnings, so the account will be tax free the rest of your life if you follow the rules on withdrawals.

In general, younger people benefit more from the Roth 401(k) because they have more time for their investments to grow tax free, but there is no simple formula to determine which choice will be better for you.

DON’T MISS OUT

If your earnings are low enough that you qualify to contribute to a Roth IRA, take advantage of the opportunity. You may soon be earning more than the threshold and not have the choice any more.

Likewise, if you work for a company that offers a Roth 401(k), put some money in there. You might change jobs in the future and no longer have that option.

There is one more avenue called a “back door Roth IRA” that makes it possible for high earners to contribute to a Roth through a two step process. Congress could close this loophole at any time, so again, assume you have limited time to build up your Roth account and take advantage of any opportunities you have to contribute.